United states net exporter of natural gas free#

customs value export values are based on free alongside ship value, U.S. exports and imports, 2014–18Ĭoal, coke, and related chemical products (EP003)

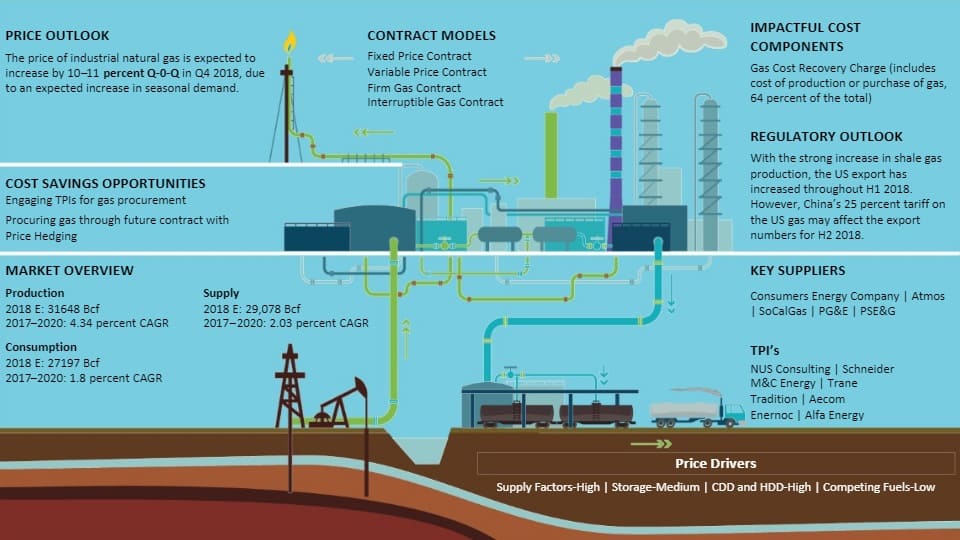

Table EP.2 Energy-related products: Leading changes in U.S. domestic exports) in these products in the most recent year. The countries are sorted by those with the largest total U.S. Calculations are based on unrounded data. Source: Compiled from official statistics of the U.S. exports and general imports, by selected trading partners, 2014–18 The average annual spot price for U.S.-origin crude of a similar quality-West Texas Intermediate (WTI)-rose from $50.80 to $65.23 (28 percent) during the same period. The price of Brent, the most widely used international benchmark for crude petroleum, rose from an annual average of $54.12 to $71.34 per barrel (32 percent) from 2017 to 2018. Compared to the shifts in average prices for crude petroleum and its products, the changes in trade volumes for most of these products (other than crude petroleum exports) were relatively small. trade of crude petroleum, petroleum products, and natural gas and components. Prices for crude petroleum and related products rose substantially from 2017 to 2018 and drove shifts in the value of U.S. exports and imports of energy-related products in value from 2017 to 2018 reflected a large increase in average prices for some energy-related products.

imports of crude petroleum and petroleum products actually declined by about 78 million barrels (2 percent) from 2017 to 2018. Even though the dollar value of these imports increased, the volume of U.S. Crude petroleum and petroleum products contributed almost all of the increase in U.S. energy-related imports were all major producers of crude petroleum and remained the same from 2017 to 2018: Canada, Saudi Arabia, Mexico, Venezuela, and Iraq. imports of energy-related products grew by $38.4 billion (19.4 percent) over the same period. energy-related exports came from crude petroleum exports (table EP.2), which increased in volume by 309 million barrels (73 percent) from 2017 to 2018. Nearly half of the overall growth in the value of U.S. energy-related exports to South Korea, the Netherlands, and Japan each rose substantially, from less than $6.0 billion in 2017 to over $9.0 billion in 2018. export market in 2017 to the seventh largest in 2018. exports to China were relatively flat (declining by less than 1 percent to $8.8 billion) and were overtaken by other markets China dropped from the third-largest U.S.

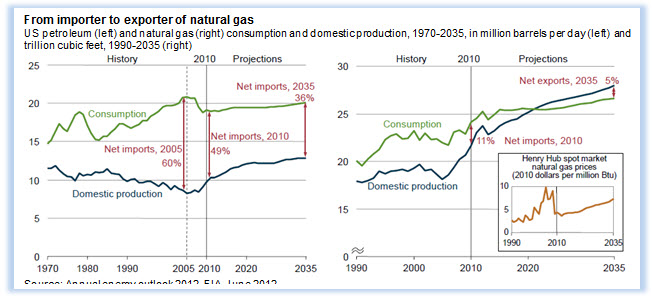

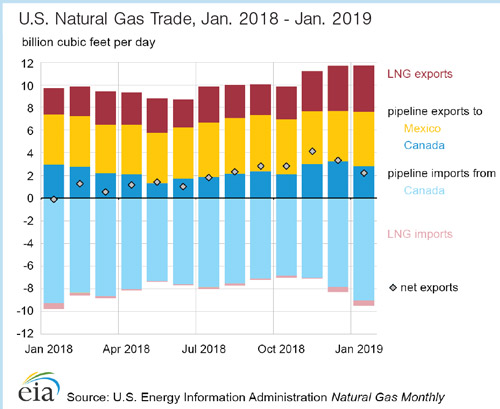

energy-related exports, with exports to both destinations rising about 30 percent in value (table EP.1). Mexico and Canada remained the top two destinations for U.S. total exports of energy-related products grew by $51.6 billion (35.7 percent) from 2017 to 2018, driven by the increase in petroleum prices and the growing volume of U.S. general imports of energy-related products: Increased by $38.4 billion (19.4 percent) to $236.4 billion total exports of energy-related products: Increased by $51.6 billion (35.7 percent) to $195.9 billion Contradicting the European energy security goals.To view changing data, hover over or touch the animated graphic below. Lower prices on European markets have led to decreasing LNG imports and increasing pipeline imports from traditional suppliers, most notably Russia. But this research found no significant evidence that these transports have been diverted to Europe in fact, the opposite has been the case. The EU is aware of the issues, it has created a LNG Strategy to improve its attractiveness as destination market.Įxisting research suggests that LNG originally destined for the United States was diverted to Europe because of the shift in the United States towards gas exports. This research acknowledges the general idea that the main concerns for exports to Europe are economic. The goal of this research was to examine the feasibility of LNG exports from the United States to Europe and to see how exports from the United States affect European energy security. Policy makers on both sides of the Atlantic wish to use this new role of the United States to enhance European energy security.īut the literature suggests that Europe is an unlikely destination for Liquefied Natural Gas from the United States. Over the past years, the United States has become a net exporter of natural gas. Liquefied Natural Gas exports from the United States and their impact on European energy security.

0 kommentar(er)

0 kommentar(er)